Spectrum Enterprise Tax

Remove the guesswork in tax jurisdiction assignments by identifying accurate local tax rates instantly

Determine tax jurisdictions accurately

Tax boundaries and rates are constantly changing, and it’s hard to keep up.

Spectrum Enterprise Tax provides an essential, automated support solution for delivering current and geographically-based determinations. The solution helps your company determine the correct tax jurisdiction in which a given address is located as well as the current tax codes that apply.

Spectrum Enterprise Tax uses advanced geocoding, parcel point, and enhanced street address matching methods providing localized geographic precision. These advanced capabilities allow the solution to assign state, county, township, municipal, and other local tax information to an address.

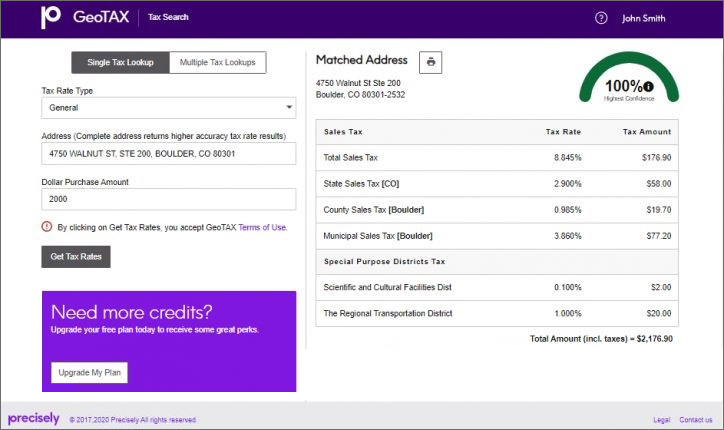

These capabilities can be deployed on premises, with our hosted API or accessed at GeoTAX.com.

GeoTAX.com: A SaaS application with an easy-to-use interface.

Access Special Tax Jurisdictions

Sales and use taxes will vary depending on location. State, county, town, and even special tax districts, such as library, emergency services, and school districts, can have their own specific taxes.

Accurate tax designations are determined by matching an address and identifying whether it is inside or outside a geographic taxing district and applying the tax appropriate to that jurisdiction.

Using the Precisely rate data, four types of tax can be returned:

-General

-Automotive

-Construction

-Medical

Both a total rate for the selected tax type and the individual rates for each local jurisdiction are returned for each transaction.

GeoTAX integrates seamlessly into the Sovos Compliance and Vertex tax solutions.

Access premium tax information

The ability to accurately assign premium tax jurisdictions is critical and companies that fall short risk overpaying, customer dissatisfaction, fines, penalties and regulatory non-compliance.

Each year, thousands of municipalities change boundaries, which are the foundation of many special tax districts. Many states require that insurance carriers use a verified geo-spatial database that appends the correct state, county, township municipality and premium tax district information to each customer record.

Insurance Premium Tax is an optional dataset, part of an integrated solution with up-to-date premium tax boundary information. Spectrum Enterprise Tax provides an ongoing research program with nationwide coverage to track these changes.

GeoTAX Insurance Premium tax is a verified solution for use in the state of Kentucky.

Automate payroll tax assignments

Employees expect 100% accuracy when it comes to their paychecks. Doing business includes thousands of tax jurisdictions and constant updates to rates and rules. Businesses need to pinpoint the tax jurisdiction of each employee to ensure the most accurate withholding.

The GeoTAX Payroll Tax module provides more accurate geographical determinations, allowing your company to automate payroll tax assignments based on an employee’s home and work address location. It offers address standardization and validation that increases the accuracy of determinations.